Best Describes Baby Boomers Ideal Retirement

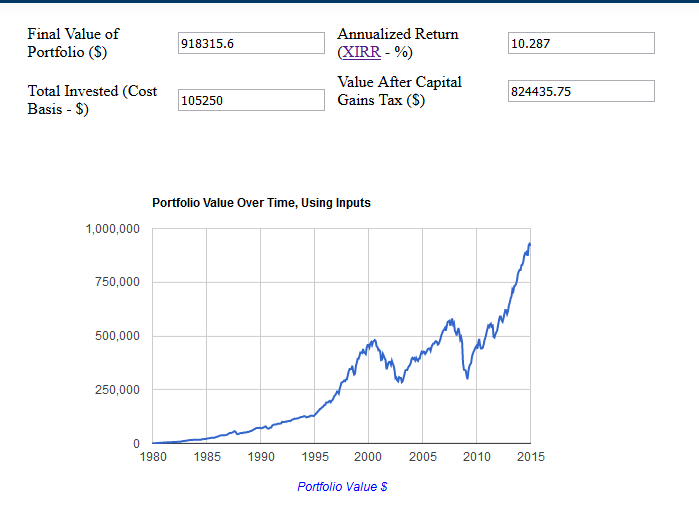

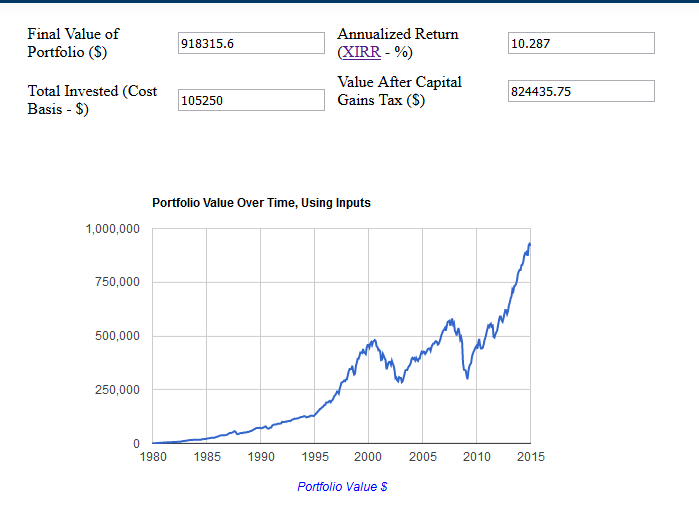

2 For those with something saved the median balance for those born between 1948 and 1953 was 290000. Louis Federal Reserve study of the retirement readiness of US.

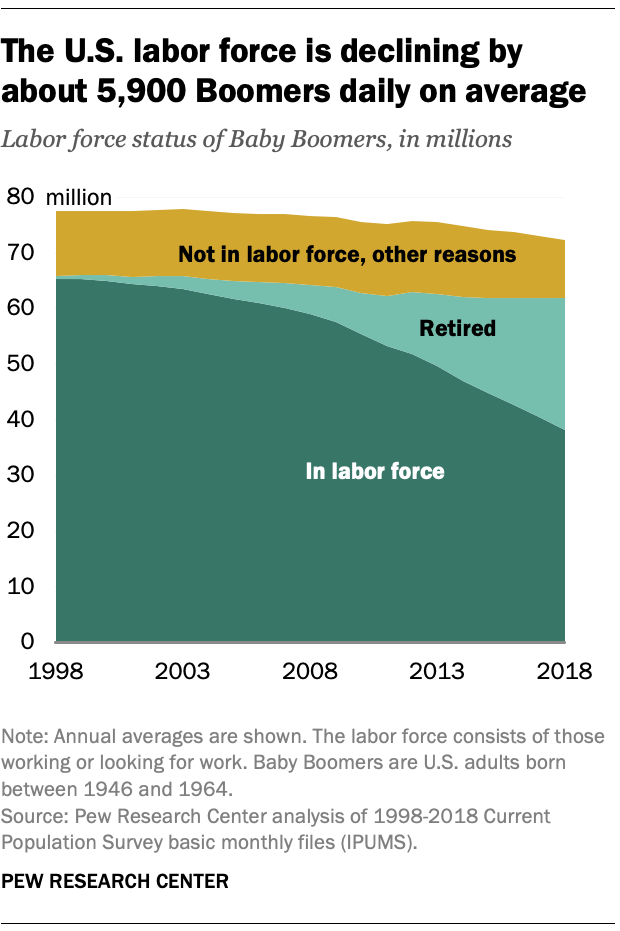

Baby Boomers Are In The Workforce Later In Life Than Past Generations Pew Research Center

Published Tue Apr 9 2019 724 AM EDT Updated Tue Apr 9.

. Baby boomers are working for the dream of retirement. It could be worrisome that for many American households. Because upcoming retirees havent saved enough for retirement.

The opportunity to enjoy a healthy lifestyle is a strong priority for many over-55 homebuyers. Here are the best places to retire in the world on a budget. Baby boomers are financially stable with higher savings and disposable incomes compared to other generations.

Youll want your savings to go toward living your ideal life not toward payments to a bank. 2023 Toyota GR Corolla. Spending less is a common way to save more for.

And a chunk of baby boomers who have no retirement savings whatsoever. Baby boomers have about 12 times more wealth than millennials. Del Webb Survey Baby Boomer Retirement Survey Working to Live Del Webb Survey Baby Boomers on by Retirement for Younger Baby Boomers Will.

If this is true then who is better skilled to create a self-motivated individualized lifestyle in retirement. For example men and women disagree about how. According to a recent study 45 of baby boomers have no retirement savings.

Baby Boomers are doing the best job of staying debt-free with 22 reporting they have no debt compared to 15 or Millennials and 14 of Gen Xers. Baby boomers face more unique challenges in retirement than any other age group and these complications are further compounded by the divisions within the baby boomer group. Baby boomer is a term used to describe a person who was born between 1946 and 1964.

How Will Boomers Deal With Retirement. Setting and achieving a goal or set of goals during the past six months to support their financial life. Preferring to save for retirement now to ensure they have a better life in retirement.

For those born between 1954 and 1959 they had saved around 209000. Feeling better about having finances planned out over the next one to two years. Studies show that people now see retirement as a time of new challenges and adventures.

This is no longer the time for a rocking chair. Under these assumptions aging baby boomers will add some 84 million households that are either single persons or married couples without children living at home. Find the best retirement communities active adult communities and places to retire.

Its tough to pinpoint any of the challenges facing Baby Boomers because its a generation that spans almost 20 years comprised of Americans born between the years of 1946 and 1964. Many of these 8 million households are expected to relocate or downsize. Try bringing a pandemic into the mix.

Despite its reputation as the wealthiest generation baby boomers generally considered to be those born between 1946 and 1964 are facing a retirement nightmare. Working diligently toward a long-term goal. Whether the intention is to earn an income or to fulfill a sense of self-worth most retiring adults plan to.

Surely the talents that led this huge group of people to restructure so. Planning for retirement is stressful enough. Yet between the stock.

Baby boomers and Gen Xers differ in their levels of confidence about whether they are doing enough to prepare financially for retirement. Despite the uncertainty spawned by the health crisis baby boomers are confident they will have a. But the best solution is to carefully plan while you can.

According to data from the Insured Retirement Institute in 2019 about 45 of baby boomers surveyed had no savings. The average baby boomer has saved about 175000 set aside for retirement Allianz says and a third has 250000. 47 Of Baby Boomers And Gen Xers Think Ideal Retirement Is Reachable Heres Why Retirement thinking differs between generations and genders.

Kathleen Peddicord March 24. Baby Boomers can be well into retirement or they can be decades away from it with kids still in primary school. Baby boomers face retirement crisis little savings high health costs and unrealistic expectations.

For baby boomers who havent planned for retirement or who find themselves short they may need to lower their expectations and consider a more modest retirement or even delay retirement. People need to really sit down and assess what their retirement will look like Sarro says. This is where we encounter a retirement paradox in baby boomers.

Baby boomers are fit and ready for some fun in retirement. The wealth gap between baby boomers and millennials isnt a gap so much as a gulf. They have the most money of any generation yet they dont have enough savings to fully fund their retirements out of pocket.

About 70 of disposable income Disposable Income Disposable Income is the money that is available from an individuals salary after heshe pays local state and federal taxes. Families came to the same conclusion but put it more gently. What You Need to Know.

Boomers have been labeled the me generation-a group whose actions often reflect the desire to make life as good as possible for its members. Each age division. Americas persistent debt problem could be why seven in 10 Gen Xers feel they could work until age 65 and still not have enough money saved to meet their retirement needs.

The baby boomer generation makes up a substantial portion of the worlds population especially in developed. Baby Boomers Seek Adventure But More Planning is Required.

Real Reasons Why The Baby Boomer Generation Has So Little Retirement Savings Seeking Alpha

101 Funny Retirement Slogans And Mottos Infographic Infographic Inspiration Baby Boomers Generation

Baby Boomer Stock Photos Images Pictures Word Cloud Food Words Stock Photos

Belum ada Komentar untuk "Best Describes Baby Boomers Ideal Retirement"

Posting Komentar